|

|

Investment and Business Valuation

-

Version

1.0

Investment and Business Valuation

-

Version

1.0

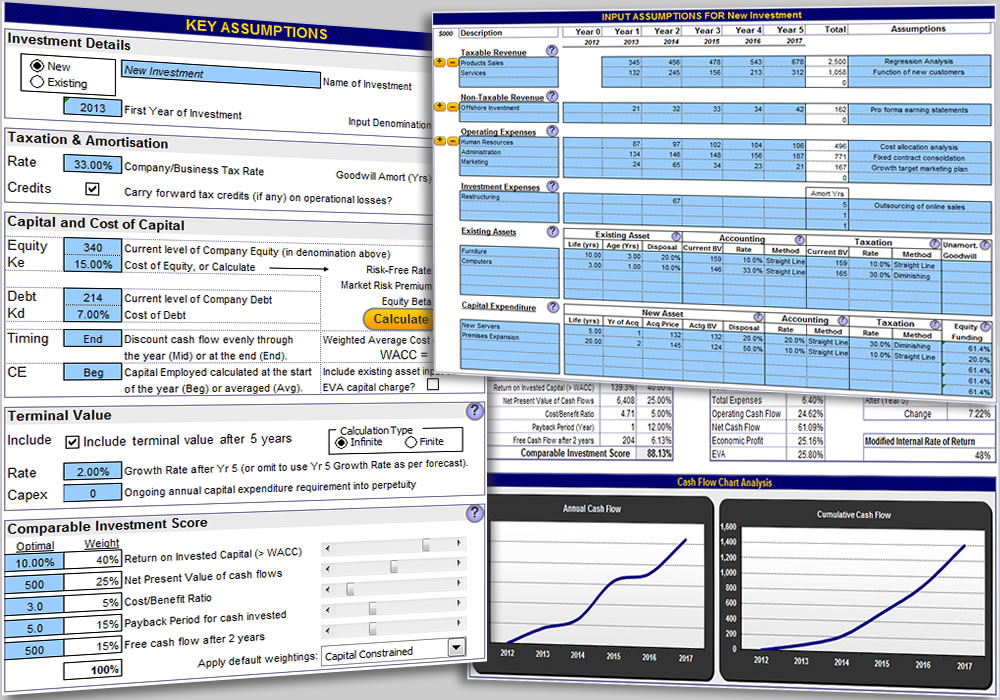

The Investment and Business Valuation template is

ideal for evaluating a wide range of investment,

financial analysis and business case scenarios. While

it is based on the traditional discounted cash flow

method of valuation, its also provides ability to

evaluate economic value added valuation, accounting

impact, and a range of other evaluation parameters.

Furthermore, the step-by-step input flow makes usage

straightforward, gaining quick results to drive

decision making. The key features of the Investment

and Business Valuation model include: Ease and

flexibility of input, with embedded help prompts; Cost

of capital calculation; Economic value added valuation

with flexibility on identifying economic costs with

specific amortization periods; Accurate handling of

asset purchase, disposal and depreciation with capital

and gearing impacts; Evaluation of new investments or

changes to existing investments; Unique 'finite'

terminal value calculation alternative to mimic

investment life cycles; and Unique Comparative

Investment Score can be set to evaluate and prioritise

|