|

|

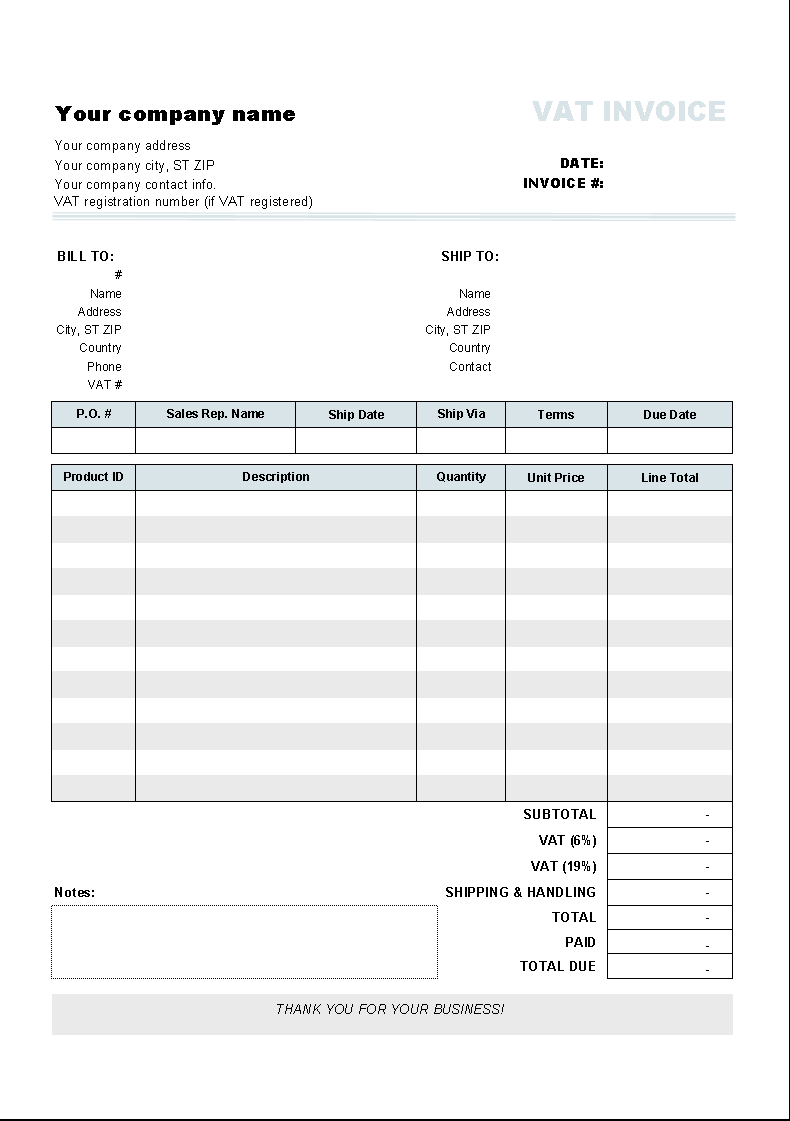

Invoice Template with Two VAT Tax Rates

-

Version

1.10

Invoice Template with Two VAT Tax Rates

-

Version

1.10

This free VAT invoice template has two VAT rates that

can be set on the bottom of the invoice form. When

creating an invoice, you choose the tax category from

a dropdown list for each invoicing item; the invoice

template calculates tax using the tax rate determined

by the tax category. If the client has a 'VAT #' (or

VAT registration number), then it is VAT-exempt. For

each line of the invoicing item, there is also

a 'Taxable' checkbox located near the left side of the

print area. If an invoicing item is not taxable,

uncheck this box to instruct the invoice template not

to calculate tax for this invoicing item.

The 'Taxable' checkbox column, 'Tax Category' dropdown

list column and tax amount column are all located

outside the print area. This makes sure that the

invoice template will not print these columns. This

form design leaves more space for you to enter

product/item description on the invoice body. The

print area, which is identified by Excel range

name 'Print_Area', defines what to print when you

|