|

|

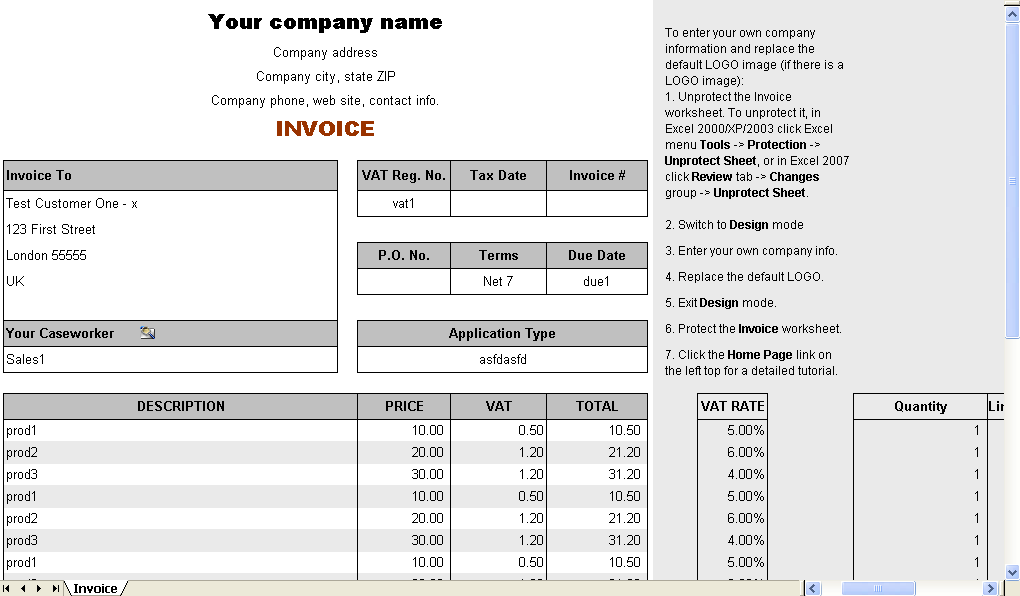

VAT Service Invoice Form

-

Version

1.10

VAT Service Invoice Form

-

Version

1.10

In UK if a business owner is registered for VAT, then

whenever it supplies goods or services to someone else

who is also registered for VAT, the supplier must give

the customer a VAT invoice. If the business is VAT

registered, you can normally only reclaim VAT on

purchases made for your business when you have a valid

VAT invoice for the purchase. A VAT invoice shows

certain VAT details of a sale or other supply of goods

and services. It can be either in paper or electronic

form. A VAT-registered customer must have a valid VAT

invoice from the supplier in order to claim back the

VAT they have paid on the purchase for their business.

This free VAT service invoice form is formatted using

UK currency symbol '£', but you can easily change it

to the currency type you like. To do this, first

unprotect the Invoice worksheet, and then drag your

mouse to select all the cells for which you want to

change their format. Then, right-click one of the

selected cells and choose Format Cells. On the Number

tab of the Format Cells dialog box, choose 'Currency'

|